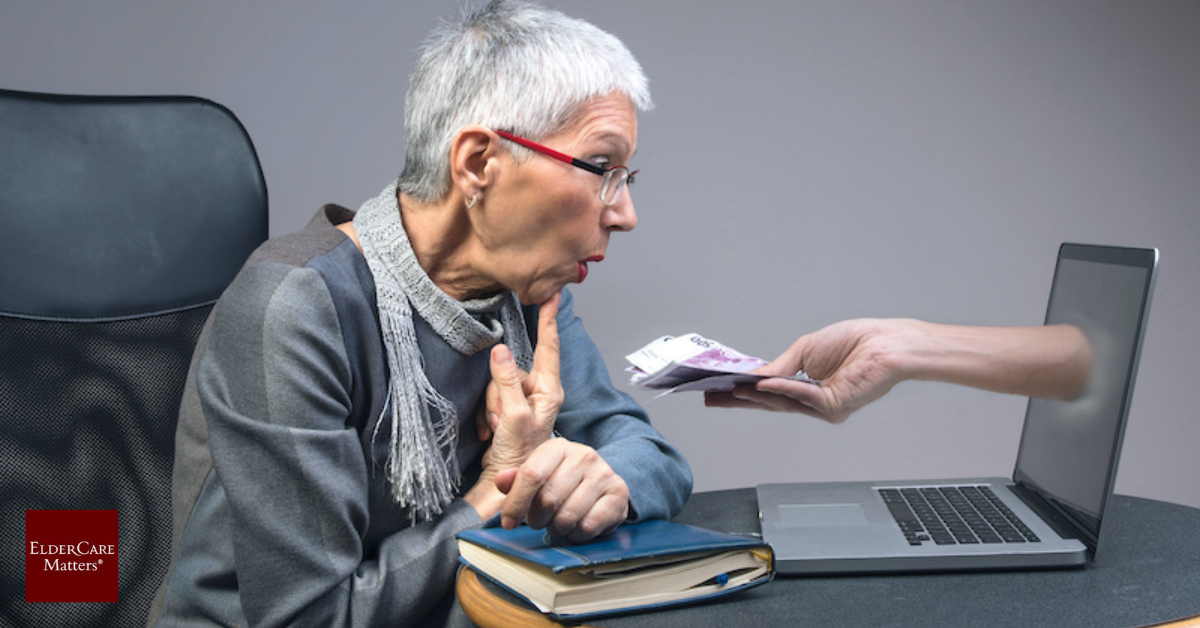

Elder fraud is a growing threat affecting thousands of seniors every year. Scammers often target older adults because they may be more trusting, isolated, or unfamiliar with modern digital schemes. When fraud happens, it can wipe out savings, cause emotional stress, and put entire families in a difficult situation. Protecting your loved one’s money starts with learning how scams work and knowing what warning signs to watch for.

Common Scams Targeting Seniors

Scammers often rely on fear or urgency to trick older adults into sending money or sharing personal data. Some of the most common elder fraud schemes include:

- Government impersonation scams: Someone pretends to be from the IRS, Social Security, or Medicare, demanding immediate payment or private information.

- Tech support fraud: A pop-up or caller claims the senior’s computer is infected and asks for remote access.

- Lottery or prize scams: The senior is told they’ve won money but must pay “processing fees” first.

- Romance scams: Fraudsters build emotional connections online and then create fake emergencies to request money.

- Family emergency scams (the “grandparent scam”): A caller pretends to be a grandchild in crisis, needing immediate cash.

These scams often sound convincing, especially when scammers use personal details gathered from the internet.

Red Flags to Watch For

Caregivers and family members should stay alert to behavioral and financial warning signs, such as:

- Sudden, unexplained withdrawals or wire transfers

- Large gift card purchases

- New “friends” who appear overly interested in finances

- Bills are not being paid when money is available

- Anxiety about answering phone calls or checking emails

- Secretive behavior about financial decisions

If something seems unusual, start a gentle conversation. Seniors may feel embarrassed or afraid, so reassurance is key.

How Caregivers Can Monitor Accounts Safely

Protecting a loved one’s finances doesn’t require taking away independence. Instead, smart monitoring and simple tools can make a big difference:

- Set up bank alerts for large or unusual transactions

- Review statements together every month

- Simplify accounts to make monitoring easier

- Use view-only access for trusted family members

- Encourage safe habits, such as never sharing information with unexpected callers

Open communication can prevent scams from going unnoticed.

What to Do If Fraud Occurs

If you suspect elder fraud, act quickly:

- Contact the bank or credit card company to freeze suspicious activity.

- Change passwords for bank accounts, emails, and devices.

- Stop all contact with the scammer.

- Report the fraud to the FTC, local police, and the FBI’s Internet Crime Complaint Center (IC3).

Fast reporting increases the chances of recovering lost funds.

Need expert guidance on protecting your loved one’s finances or navigating elder care challenges?

👉 Visit ElderCareMatters.com – America’s National Directory of Elder Care Resources for trusted elder care and legal resources.

Reading Time: 2.76 mins.